by John Keller | Dec 18, 2014 | Fuel Price Management Solutions, Fuel Pricing Strategy, Industry News

At the close of the NYMEX today, Oil traded at $54.70 bbl, down $1.77 from yesterday. Gas prices continue to plummet across the US, and experts predict that gas prices are not yet at their lowest.

That’s a pretty safe prediction, given that it takes time for decreased NYMEX oil prices to make their way through refining, to wholesale, to the retail channel. And since a $5 drop in crude can equate to a $0.12 drop in gas prices, it’s not unreasonable to expect retail fuel prices to drop that much in the coming days. Many fuel retailers are experiencing a time when their replacement margins are routinely below their actual margins, since the cost of buying a new load today is less than what they paid yesterday (or last week, depending on how quickly they turn over the inventory in their tanks).

What does this mean from a fuel price management perspective? First, it means we can expect to see increased retail fuel margins to finish off the year. That should make Q4 of this year one of the strongest in recent history.

Second, it’s important to consider that the retail fuel pricing game is not as simple as the basic price elasticity principles you learned in Microeconomics 101. Consumer psychology is always at play. As a wise fuel manager once taught me, sometimes lower gas prices lead to the customer reaction of waiting to see if the prices drop even further. And now that the US culture has started to get used to falling gas prices, just because you drop retail fuel prices at your locations doesn’t mean you’ll automatically see an uptick in fuel volumes.

The retail fuel pricing business requires no less finesse in these times than in times of low fuel margins. Fuel pricing software like PriceAdvantage continues to be critical for analyzing your business so you can always have the right price at every store all the time.

by John Keller | Dec 12, 2014 | Fuel Price Management, Fuel Pricing Strategy, Industry News, Retail Fuel Margins

According to OPIS, the average retail fuel margin across the US just made its largest increase of the year, jumping $0.097 per gallon from last week. That means we have an average retail fuel margin of over $0.30 a gallon for the fourth time this year. This week the retail fuel margin average is $0.336. That’s $0.145 per gallon higher than this week last year.

The year to date retail fuel margin average now stands at $0.211 per gallon. The Q4 average is $0.290 per gallon, and the six week average is $0.271 per gallon.

This is not the time of year where we see high fuel volumes from miles driven, so these margins don’t have as much of a revenue impact as they would during the summer months. But at least we can expect to see strong margin opportunities through the Christmas holiday season into New Years.

by John Keller | Dec 12, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

As reported in an earlier blog article, in their attempt to defend market share, Saudi Arabia decided last month to continue their oil production despite pressure from other OPEC members to cut back. In so doing, Saudi Arabia anticipated that oil would settle at $60 a barrel, and apply pressure to US drilling efforts that cannot break even at that price point.

Yesterday oil closed at just under the $60 mark, and today it closed at $57.50 per barrel. So the Saudi strategy seems to be happening even faster than some may have thought.

Already there are US drilling companies who are backing off plans to drill in sites where it costs more than $60 a barrel to extract the oil. Others are looking into capping some drilling locations, though that isn’t always an option based on signed contracts. According to the Wall Street Journal, new drilling permits have dropped sharply. ConocoPhillips announced they will spend 20% less next year on drilling wells, focusing only on the most profitable spots.

However, there are still spots in South Texas where drilling is still profitable even at $30 a barrel. The Bakken area in North Dakota has a break even point at just under $50 a barrel.

We can’t attribute the global price drop of crude entirely to the Saudi decision. Weaker anticipated demand in Asia also has a significant impact. But no doubt, as long as OPEC continues with their production levels, and the US stays close to what it’s producing now, we can expect to be awash in oil, and see oil prices the lowest we’ve seen in years.

by John Keller | Dec 8, 2014 | Fuel Price Management, Fuel Pricing Strategy, Industry News, Retail Fuel Margins

There’s a terrific article in the Emporia Gazette, a publication in Emporia, Kansas, about why diesel prices are dramatically lagging the drop of gasoline prices we’ve seen over the past months.

In June, US crude was trading at just over $106 bbl, its peak of the year. Since then, the price of crude has dropped about 35%. Gasoline prices have fallen roughly 24% over that same time period. That’s not unusual, since it always takes time for crude price changes to make their way down the supply chain to the retail channel. What does seem odd is that diesel prices have only fallen about 9%. In some areas, the spread between regular unleaded gasoline and diesel is $0.81 a gallon, in other areas the spread is nearing $1 a gallon.

As the article explains, the reason for this gap can be summarized in five points:

1. The US federal tax on diesel fuel is 6 cents more per gallon than gasoline, so the fixed cost of diesel will always be higher.

2. The US demand for fuel used for traffic is changing. The year over year demand for gasoline in the US has been gradually trending downward, in large part due to increased gas mileage efficiency of fleet cars. But the US demand for diesel this year has been much stronger, in large part due to the increase in truck traffic caused by a stronger US economy.

3. Diesel needs to be considered its own commodity, independent of gasoline, because there is substantial demand for diesel outside of car and truck traffic. More equipment is burning diesel, most notably the equipment that fracks crude out of shale formations, and with the rise in US oil production, that equates to a big deal. Also, it has been a late harvest in the Midwest US, and busy farmers make for busy equipment that demands more diesel. Finally, since heating oil and diesel are essentially the same, the recent cold weather and heavy snow across the US has led to a corresponding increase in demand for home heating oil.

4. US refineries are built to primarily produce gasoline, not diesel. From each barrel of oil, US refineries produce 18 to 21 gallons of gasoline vs. 10 to 12 gallons of diesel fuel. It would take billions of dollars to pay for the significant upgrades needed for refineries to create a higher percentage of diesel.

From a fuel price management perspective, it’s unlikely we’ll see any short term dramatic diesel cost decreases, since diesel demand should hold steady as the US economy continues to grow, winter has set in, and there is no end in sight for fracking. When comparing year over year demand for diesel, you may see a positive volume trend, depending on the customer type at your locations.

by John Keller | Dec 6, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

The OPIS report today revealed another slight drop in the average US retail fuel margin. The US average now stands at $0.239 per gallon, down $0.019 per gallon from last week. The year to date average margin was up slightly to $0.209 while the Q4 average was down slightly to $0.285 per gallon. The six week average dropped over $0.02 to $0.267 per gallon.

Despite the second consecutive weekly drop, the average retail fuel margin still stands $0.029 higher than this same week last year.

With only three more reports coming this year, we can expect the average margin for the year to be a solid $0.209 per gallon, which would be a solid $0.01 per gallon higher than last year. The most exciting news will be to see how strong Q4 can finish. Last year the fourth quarter sported a $0.200 per gallon average. So far we’re over $0.08 per gallon above that. It’s unlikely we’ll see any dramatic margin drops through the end of the month that would take us below that $0.08 gap. From a fuel price management perspective, that means we can expect solid earnings for Q4.

by John Keller | Dec 5, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

According to the Wall Street Journal today, Saudi Arabia increased the oil prices discount to the US and Asia, showing a strong commitment to defend market share against US production. The US price dropped between $0.10 and $0.90 a barrel to the US, and between $1.50 and $1.90 a barrel to Asia.

As reported earlier, Saudi Arabia is expecting crude prices to settle at $60 a barrel. Kuwait announced yesterday the country is basing their 2014-2015 budget on barrel prices of $55-$60 a barrel. Depending on the expert you read, that is anywhere from just at break even to $16 a barrel below break even.

At the time of this writing, global crude prices are slightly lower.

by John Keller | Dec 5, 2014 | Fuel Price Management, Fuel Price Optimization, Fuel Pricing Technology, Fuel Software, Industry News, Retail Fuel Margins

OPEC announced on Thanksgiving that they would not cut back their production. According to the Wall Street Journal, Venezuela was pushing for a considerable cut in OPEC production prior to the meeting. When Russia, which isn’t a member of OPEC, decided to maintain their production levels and not join in any plan to cut output, Saudi Arabia argued that the group must defend market share rather than prices. That decision became final as the cartel is now appearing that they will not push for supply cuts in the immediate future.

Saudi Arabia is now anticipating oil prices could settle at $60 a barrel, approximately $9 a barrel less than now. According to the US Energy Information Administration, if every $10 drop in the price of a barrel of crude is passed on to the consumer, that would equate to a $0.24 drop in the price of a gallon of gas.

From a fuel price management perspective, that means we could see average gas prices in the $0.20 to $0.30 range lower than today in the coming weeks. And as always, falling gas prices mean lower fuel revenues but stronger retail fuel margins.

What else can we expect from these lower oil prices? Auto manufacturers have reported robust November sales, especially in trucks and luxury vehicles that get lower gas mileage, and perhaps require premium fuel. Meanwhile, Toyota has reported that sales of its hybrid Prius are down 14% year over year. This could mean a slowing of the ongoing trend of reduced demand for fuel caused by increasingly more fuel efficient vehicles on the street. But of course it is important to consider that even today’s less than highly fuel efficient new vehicles are likely more fuel efficient than the vehicles they are replacing. So it is unlikely that the reduced fuel demand trend will reverse completely.

We live in historic times, as witnessed by the constant news articles about oil prices and gas prices. If savvy fuel analysts play their cards right and invest in premiere retail fuel pricing software technology, there is quite a bit of money to be made.

by John Keller | Nov 28, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

The latest OPIS report shows the average retail fuel margin across the US declined $0.014 per gallon to $0.258 per gallon. The year to date average is $0.208 and the quarter to date average is $0.290 per gallon. The six week average is $0.289 per gallon.

The retail fuel margin level this week remains $0.129 higher than this time last week.

Retail fuel margins have dropped five of the last six weeks, behavior similar to what we saw last year at this time. Despite this six week drop of $0.112 per gallon, we’re still seeing a Q4 retail fuel margin average that is $0.09 per gallon higher than Q4 of 2013.

The Thanksgiving holiday weekend is still underway, and if demand turns out to be as predicted, retail fuel marketers will end the month on a solid note.

by John Keller | Nov 25, 2014 | Fuel Price Management, Industry News

Thanksgiving morning Eastern Standard Time, OPEC will be meeting in Vienna Austria to decide how to react to the dramatic drop in global oil prices over the past months. The press conference is scheduled for 10am EST, so we’ll be able to ponder their decision over our Thanksgiving feasts.

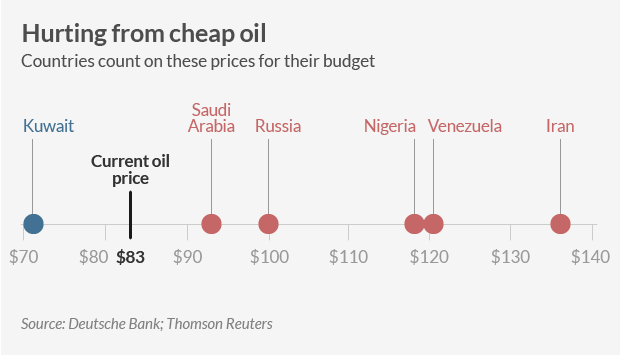

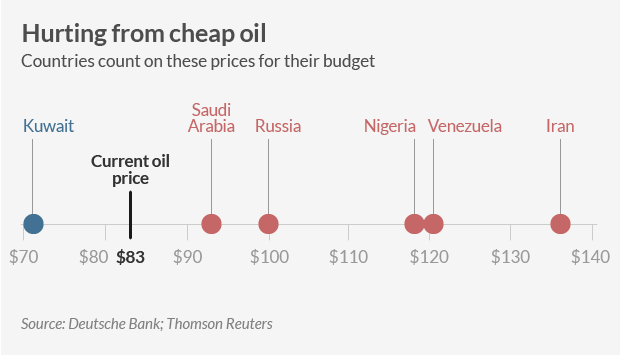

OPEC member Venezuela counts on oil prices in the range of $120/barrel for its budget, so Venezuela is doing what it can to try to convince Saudi Arabia to reduce oil output. Saudi Arabia counts on just over $90/barrel for its budget, but with its large cash reserves, the country can use its cushion to wait out what it sees as these tough times when oil is trading below $80/barrel. Saudi Arabia views Iran as an enemy, and since Iran uses nearly $140/barrel for its budget, the Saudis are in no hurry to make things easier on Iran.

Saudi Arabia is very aware of how much the recent increase in US production has impacted global oil prices. Many energy experts say that the Saudis are likely to see lower oil prices in the short term as a way to pressure the US to lower their long term production projects. Lower oil prices will make it tougher for independent US producers to launch new drilling projects in places like the Eagle Ford Shale in South Texas or the Bakken formation of North Dakota because they rely on high returns to finance the costly penetration and oil harvesting in those formations (see an excellent article referencing this in USA Today here).

When polled what announcement OPEC will make on Thursday, a Bloomberg panel of experts split evenly between predicting OPEC will do nothing with their current production level, and predicting OPEC will cut production. While the general consensus is that OPEC does not have the same clout they had in the 70’s and 80’s, OPEC still produces approximately 40% of the world’s oil and hold 80% of its oil reserves. That means OPEC still carries considerable clout.

From a fuel price management perspective, though it takes months for the change in the cost of a barrel of crude to make its way to the wholesale and retail chain, speculators can cause a magnification in price changes via the futures markets, and accelerate the effect on the cost of gasoline. We’ll be watching anxiously to see what decision comes from what some are calling the most significant meeting in recent OPEC history.

by John Keller | Nov 21, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

According to the AAA, the number of Americans who will drive 50 miles or more for the Thanksgiving holiday will be 4.3% higher than last year and the highest number since 2007.

According to Marshall L. Doney, AAA President and Chief Operating Officer, Americans are more optimistic about the future, based on several key economic factors including employment, GDP and disposable income, causing an increased desire to travel.

With fuel retailers seeing some of the strongest margins of the year, this holiday should turn out to be a highly profitable one. With retail fuel prices being about $0.43 per gallon lower than this time last year, that gives everyone plenty to be thankful for, both on the consumer and the retailer side.