by John Keller | Nov 25, 2014 | Fuel Price Management, Industry News

Thanksgiving morning Eastern Standard Time, OPEC will be meeting in Vienna Austria to decide how to react to the dramatic drop in global oil prices over the past months. The press conference is scheduled for 10am EST, so we’ll be able to ponder their decision over our Thanksgiving feasts.

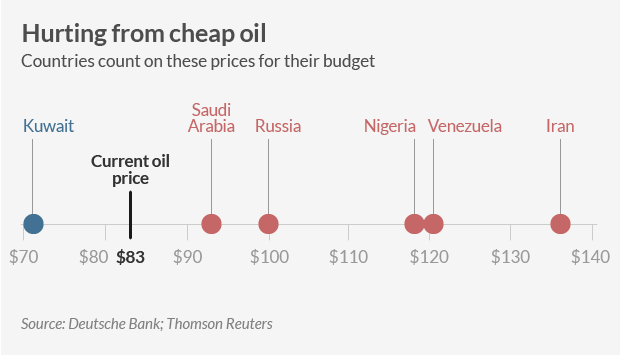

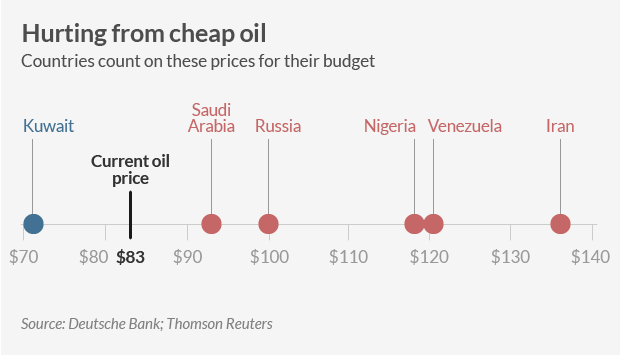

OPEC member Venezuela counts on oil prices in the range of $120/barrel for its budget, so Venezuela is doing what it can to try to convince Saudi Arabia to reduce oil output. Saudi Arabia counts on just over $90/barrel for its budget, but with its large cash reserves, the country can use its cushion to wait out what it sees as these tough times when oil is trading below $80/barrel. Saudi Arabia views Iran as an enemy, and since Iran uses nearly $140/barrel for its budget, the Saudis are in no hurry to make things easier on Iran.

Saudi Arabia is very aware of how much the recent increase in US production has impacted global oil prices. Many energy experts say that the Saudis are likely to see lower oil prices in the short term as a way to pressure the US to lower their long term production projects. Lower oil prices will make it tougher for independent US producers to launch new drilling projects in places like the Eagle Ford Shale in South Texas or the Bakken formation of North Dakota because they rely on high returns to finance the costly penetration and oil harvesting in those formations (see an excellent article referencing this in USA Today here).

When polled what announcement OPEC will make on Thursday, a Bloomberg panel of experts split evenly between predicting OPEC will do nothing with their current production level, and predicting OPEC will cut production. While the general consensus is that OPEC does not have the same clout they had in the 70’s and 80’s, OPEC still produces approximately 40% of the world’s oil and hold 80% of its oil reserves. That means OPEC still carries considerable clout.

From a fuel price management perspective, though it takes months for the change in the cost of a barrel of crude to make its way to the wholesale and retail chain, speculators can cause a magnification in price changes via the futures markets, and accelerate the effect on the cost of gasoline. We’ll be watching anxiously to see what decision comes from what some are calling the most significant meeting in recent OPEC history.

by John Keller | Nov 21, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

According to the AAA, the number of Americans who will drive 50 miles or more for the Thanksgiving holiday will be 4.3% higher than last year and the highest number since 2007.

According to Marshall L. Doney, AAA President and Chief Operating Officer, Americans are more optimistic about the future, based on several key economic factors including employment, GDP and disposable income, causing an increased desire to travel.

With fuel retailers seeing some of the strongest margins of the year, this holiday should turn out to be a highly profitable one. With retail fuel prices being about $0.43 per gallon lower than this time last year, that gives everyone plenty to be thankful for, both on the consumer and the retailer side.

by John Keller | Nov 21, 2014 | Fuel Price Management, Industry News, Retail Fuel Margins

After four consecutive weekly declines, the average retail fuel margin across the US rebounded $0.025 per gallon this week, according to OPIS. That brings the national average to $0.272 per gallon, which is $0.13 per gallon higher than last year at this time.

The year to date average is $0.207, slightly higher than this time last year when the year to date average was $0.191 per gallon. The average for the quarter is a robust $0.294 per gallon, while the six week average is $0.308 per gallon.

According to Schneider Electric, US refineries are at a strong run rate, yielding a greater supply of gasoline and increased gas inventories. That means we can expect a different trend over the upcoming weeks than what we saw last year at this time, and retail fuel margins should remain strong as gas prices continue to decline.

by John Keller | Nov 21, 2014 | Fuel Price Management, Fuel Pricing Strategy, Industry News, Retail Fuel Margins

According to an article written by Brian Milne of Schneider Electric and published in Convenience Store Decisions, US refineries are increasing their production after being down for maintenance, bringing the run rate above 90%. That’s a run rate last seen in mid-September.

What does that mean from a fuel price management perspective? The higher run rate will lead to a greater supply of gasoline, gas inventories will increase, wholesale fuel prices will push lower, and ultimately retail fuel prices will continue to decrease leaving open the opportunity for robust fuel margins.

In November, the US Energy Information Administration lowered their predicted average retail fuel price to $2.94 per gallon in 2015, which is 13% lower than their predicted price in October. Likely that will lead to increased demand for fuel, or at least steady demand levels compared to this year.

by John Keller | Nov 19, 2014 | Customer News, Fuel Pricing Technology, Fuel Software, Industry News, Retail Fuel Margins

CST Brands announced their financial results for the quarter ending September 30, 2014. Earnings were $.90 compared to expectations of $.57.

From the report: “Motor fuel gross profit (per gallon) in the U.S. for the third quarter of 2014, after deducting credit card fees, was $0.25 compared to $0.16 in the third quarter of 2013, which was primarily caused by a declining crude oil and wholesale gasoline pricing environment combined with the Company’s fuel pricing strategy.” [bolded text from this author]

In the US stores separately, the numbers are as follows:

- Q3 retail fuel margin before credit card fees of $0.288 per gallon up from $0.203 for Q3 in 2013

- Q3 gallons per site per day of 4,921 gallons or approximately 152,000 gallons per month

- Q3 NTI stores gallons per site per day of 9,547 gallons or 295,000 gallons per month

The numbers are quite impressive, and the financial analysts are noticing. CST stock is now trading at $43.27 a share, up 23% over the past three months, and up 32% for the year.

by John Keller | Nov 18, 2014 | Customer News, Fuel Pricing Strategy, Fuel Pricing Technology, Industry News

In the November 2014 issue of CSP Magazine, Greg Parker explains how the success of Parker’s has allowed the company to achieve his extraordinary goals. You may find the article online here.

Previously, Mr. Parker had written a guest article for CSP magazine’s October 2013 issue, where he outlined what he calls a “Big, Hairy, Audacious Goal” to grow the Parker’s Company from a $500 million company to a multibillion one over the upcoming decade.

The numbers in the article are quite impressive:

- eight stores built in 10 months

- EBITDA (earnings before interest, taxes, depreciation and amortization) has increased 36.8%

- overall gas sales at Parker’s have increased by 33% over last year

- gas sales for stores open at least a year have increased by 5.9% over the previous year

- in-store sales have surged to 28% over last year

The PriceAdvantage team is proud to have Parker’s as a customer and partner. For many years, Parker’s has been an electronic gas price sign customer of Skyline Products, the parent company of PriceAdvantage. In January 2012, Parker’s completed their rollout of PriceAdvantage to all their stores. Besides using Skyline electronic gas price signs, the Parker’s fuel price management solution also includes the PriceAdvantage integration with the NCR Radiant POS and GasBuddy OpenStore. Click here to see a video interview with Jeff Bush, Director of Fuel Management at Parker’s, discuss how he uses PriceAdvantage Optimization.