-

- 25 Nov

OPEC meets on Thanksgiving, press conference 10am EST

Thanksgiving morning Eastern Standard Time, OPEC will be meeting in Vienna Austria to decide how to react to the dramatic drop in global oil prices over the past months. The press conference is scheduled for 10am EST, so we’ll be able to ponder their decision over our Thanksgiving feasts.

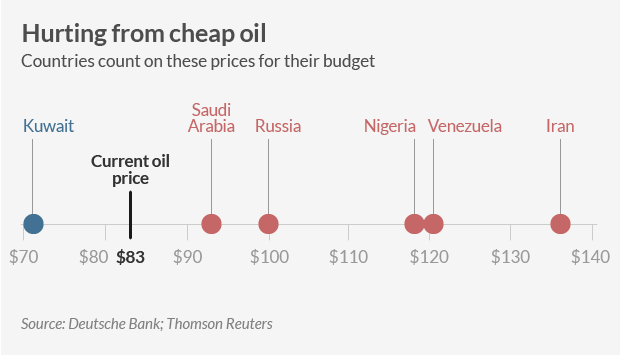

OPEC member Venezuela counts on oil prices in the range of $120/barrel for its budget, so Venezuela is doing what it can to try to convince Saudi Arabia to reduce oil output. Saudi Arabia counts on just over $90/barrel for its budget, but with its large cash reserves, the country can use its cushion to wait out what it sees as these tough times when oil is trading below $80/barrel. Saudi Arabia views Iran as an enemy, and since Iran uses nearly $140/barrel for its budget, the Saudis are in no hurry to make things easier on Iran.

Saudi Arabia is very aware of how much the recent increase in US production has impacted global oil prices. Many energy experts say that the Saudis are likely to see lower oil prices in the short term as a way to pressure the US to lower their long term production projects. Lower oil prices will make it tougher for independent US producers to launch new drilling projects in places like the Eagle Ford Shale in South Texas or the Bakken formation of North Dakota because they rely on high returns to finance the costly penetration and oil harvesting in those formations (see an excellent article referencing this in USA Today here).

When polled what announcement OPEC will make on Thursday, a Bloomberg panel of experts split evenly between predicting OPEC will do nothing with their current production level, and predicting OPEC will cut production. While the general consensus is that OPEC does not have the same clout they had in the 70’s and 80’s, OPEC still produces approximately 40% of the world’s oil and hold 80% of its oil reserves. That means OPEC still carries considerable clout.

From a fuel price management perspective, though it takes months for the change in the cost of a barrel of crude to make its way to the wholesale and retail chain, speculators can cause a magnification in price changes via the futures markets, and accelerate the effect on the cost of gasoline. We’ll be watching anxiously to see what decision comes from what some are calling the most significant meeting in recent OPEC history.